Today’s companies operate in a VUCA (volatile, uncertain, complex and ambiguous) world, where the expectations of customers, employees and investors are changing rapidly. In this “new normal,” organizations must no longer be satisfied with good financial performance alone. They must aim for sustainable performance, which takes into account environmental, social and governance (ESG) issues.

Implementing a CSR (Corporate Social Responsibility) strategy that incorporates ESG criteria is essential to reaching this goal. However, you also need to understand what these criteria are. If you’re interested in this subject, then hang tight, as this is where we explain:

- What “ESG” means

- Why you need to incorporate it into your CSR strategy

- How to get there

What are ESG criteria?

Definition

The abbreviation “ESG” refers to three criteria used to assess a company’s extra-financial performance:

- Environmental: This criterion focuses on the company’s impact on the environment. It includes managing natural resources, reducing carbon emissions, and recycling.

- Social: This refers to the company’s impact on its employees and on society as a whole. It includes quality of work life (QWL), diversity and inclusion, and impact on local communities.

- Governance: This criterion looks at how the company is managed. This includes criteria such as transparency, ethics, regulatory compliance, and anti-corruption.

ESG versus CSR

Although ESG criteria and CSR (Corporate Social Responsibility) share common objectives, it’s important to understand what differentiates them.

CSR is a voluntary, internally driven approach that involves all activities within a company. It seeks to improve the organization’s social, environmental and economic impact through responsible practices.

ESG criteria, on the other hand, help investors assess risks and opportunities associated with environmental, social and governance practices, as well as their potential impact on a company’s performance. They are often used to “score” companies in stock market indexes or sustainability audits.

In other words, CSR helps structure a company’s responsible actions, while ESG evaluates the effectiveness of these actions. These are two complementary concepts!

Why use ESG criteria?

Incorporating ESG criteria into your CSR strategy offers many advantages. Here are four valid reasons why.

Attract and retain top talent

Today, 70% of employees say knowing about their future employer’s ESG initiatives is important even before they accept a job offer. Yet only 30% feel that their company has a positive impact on society and the planet. This gap shows that companies have a real opportunity to improve their attractiveness by strengthening their ESG commitments.

What’s more, 19% of employees consider their company’s ESG policy to be just as important or even more important than their salary. Making commitments in this area can help employees find meaning in their work, develop a sense of belonging, and stay longer.

Enhance reputation

According to PwC, companies that make a serious commitment to ESG issues gain credibility and stand out from the competition. This commitment can also attract new customers and partners who share the same concerns. By showing they’re committed to sustainable approaches, companies can create synergies with other responsible actors, thereby strengthening its own market position and brand.

Access new sources of financing

90% of professional investors worldwide have adopted ESG criteria! Using ESG criteria can thus pave the way to more responsible financing and offer more advantageous terms—all the while reassuring investors about the company’s long-term stability.

Foster innovation and sustainable performance

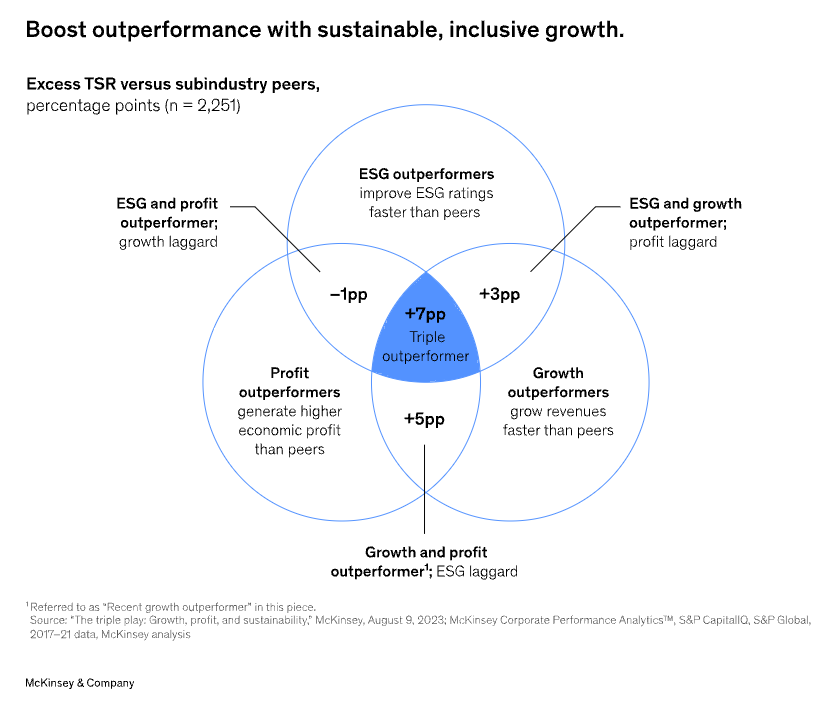

To integrate ESG criteria into their CSR approach, companies need to rethink their strategies and practices. This encourages them to innovate, anticipate market trends, demonstrate resilience, and thus become more competitive over the long term. One McKinsey study indeed shows that companies which outperform their peers in terms of growth, profitability, and ESG performance generate a total shareholder return (TSR) more than 7 percentage points higher than the average.

How can you integrate ESG criteria into your CSR strategy?

If the above arguments have convinced you, then you may be wondering how you can integrate ESG criteria into your CSR strategy. Here are the key steps to follow.

1. Set clear ESG goals

The first step is to define ESG objectives that are clearly aligned with your strategic priorities. Ask yourself what problems you want to solve: is it reducing your carbon footprint, improving working conditions, or increasing transparency?

Once you’ve defined your priorities, use the OKR method (objectives and key results) to set ambitious but achievable ESG targets. For example, one of your environmental objectives might be “to reduce CO₂ emissions by 20% within the next two years.”

2. Implement initiatives aligned with your objectives

Now that you’ve set your goals, it’s time to get the ball rolling! Here are a few examples of CSR initiatives to implement for each ESG component:

Environmental:

- Launch a zero-waste policy: encourage selective sorting, reduced packaging, and recycling of materials (particularly in the production chain).

- Draw up an annual CO₂ balance sheet that tracks your direct and indirect emissions.

- Work with local suppliers and partners who share your ESG commitments.

Social:

- Implement a diversity and inclusion policy.

- Improve employee working conditions by offering flexible working hours, remote work, and wellness programs.

- Create a professional development program to develop employees’ skills.

Governance:

- Adopt a governance model such as a Holacracy or Sociocracy to improve transparency and make decision-making more participative.

- Direct investments towards companies or projects that respect ESG criteria.

- Create a committee specifically dedicated to overseeing ESG initiatives.

Want to discover still more innovative organizational models that will help you reach your governance goals? Download our dedicated white paper:👇

3. Track your ESG score regularly

To assess the effectiveness of your initiatives, track your ESG performance on a regular basis. Several rating platforms can help you determine this score, including MSCI, S&P Global, Bloomberg, or Sustainalytics. These tools enable you to track your progress, compare your score with those of your competitors, identify areas for improvement, and thus continuously improve your performance.

4. Communicate your approach

Finally, it’s crucial to communicate effectively about your initiatives, both internally and externally. Internally, you can use tools like Talkspirit to share your successes via publications, and mobilize your teams around your ESG commitments.

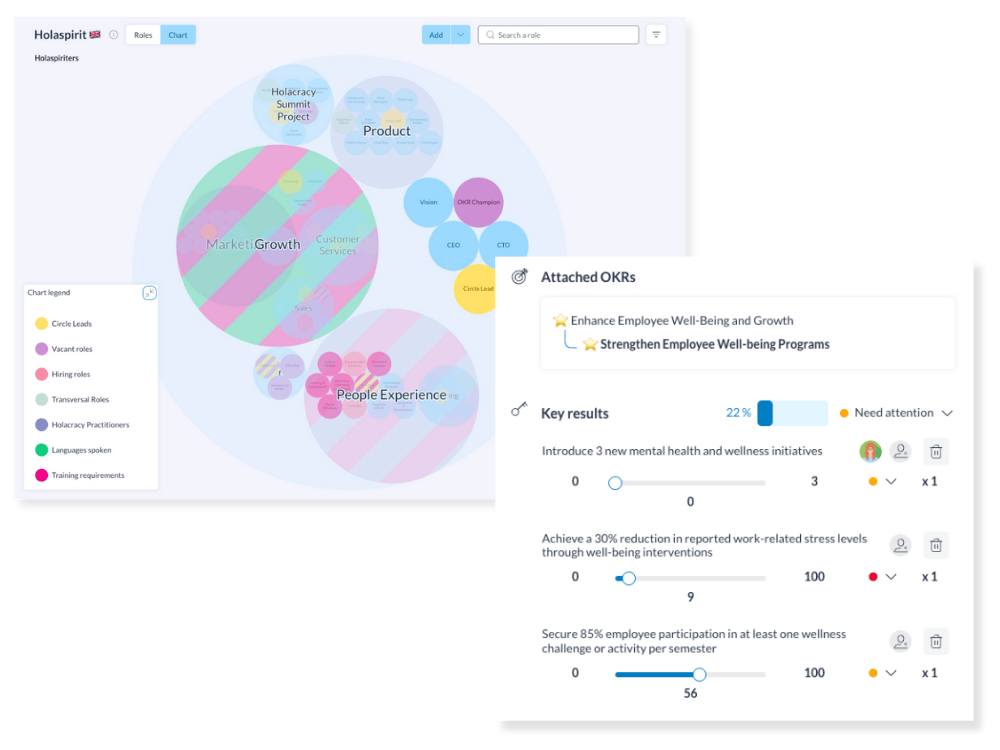

You can also use the Holaspirit platform to:

- map your organization’s roles using an AI-powered org chart

- define your ESG goals through the OKR method

- clarify how ESG impacts everyone’s roles and responsibilities

- bring transparency to issues such as compensation, performance assessment, and organizational culture

- document the policies and processes put in place to achieve your ESG goals

To communicate externally, the best practice is to publish an annual ESG report that details your progress, initiatives, and results. This allows you to highlight the impact of the actions you’ve put in place, reinforcing your stakeholders’ confidence. This is a medium you can use in a variety of ways (think press release or shareholder meeting, just to name two examples).

A final word

Integrating ESG criteria into your CSR strategy becomes no longer just an option. Guaranteeing sustainable performance is essential for attracting and retaining talent and meeting your stakeholders’ expectations.

For this approach to be effective, you also need transparency. To this end, you need to implement the right actions—but also the right tools! Platforms like Talkspirit and Holaspirit can help you structure, monitor, and communicate more effectively on your ESG initiatives. So don’t hesitate to give it a try!

PS: Want to explore more tools for improving governance, communication, and collaboration on ESG topics? Check out our white paper, “What Software Tools Are a Must-Have for the Next-Generation Enterprise?” 👇

Access White Paper

In our white paper “What Software Tools Are a Must-Have for the Next-Generation Enterprise?,” you’ll discover: how tools shape organizations and their culture, what collaborative and governance tools next-generation companies are using, and what the latest adoption trends for enterprise software platforms.